Commercial Aviation in 2020: downturn in airline passengers, employment, profits, and flights operated, in the wake of COVID-19, was partially mitigated by increases in air cargo

Data spotlights represent data and statistics from a specific period of time, and do not reflect ongoing data collection. As individual spotlights are static stories, they are not subject to the Bureau of Transportation Statistics (BTS) web standards and may not be updated after their publication date. Please contact BTS to request updated information.

Any review of “Commercial Aviation in 2020” must address the year’s biggest story: Beginning last February, the spread of COVID-19 triggered a significant drop in the number of operated flights and ticketed passengers. That led, in turn, to a measured decline in airline profits and employment in the passenger sector. It’s important, however, to note that there was growth in the volume of air cargo and an increase in on-time arrival performance.

By May, airlines adjusted their schedules to meet the pandemic-reduced demand.

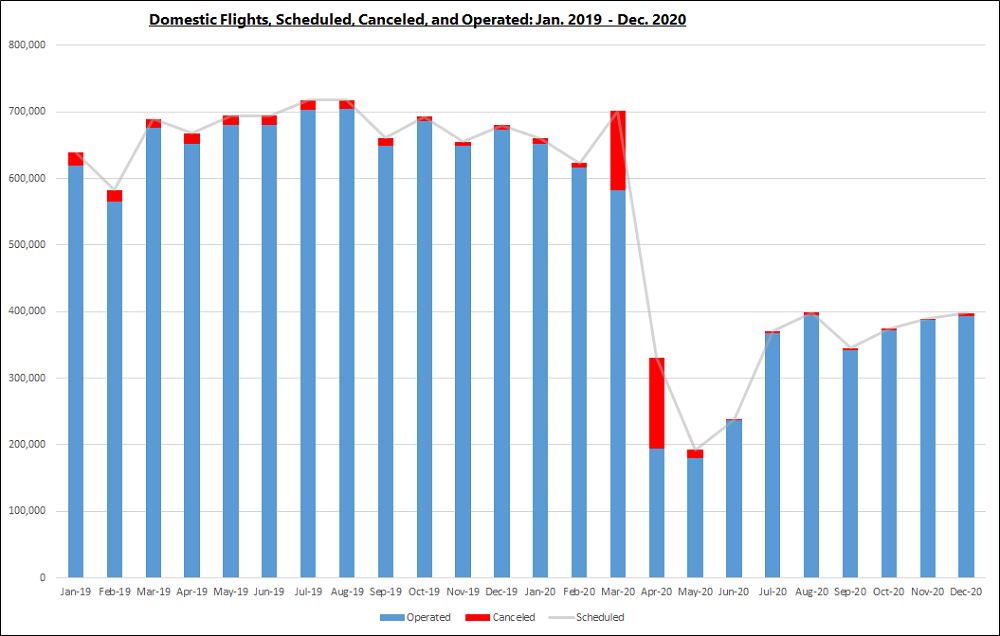

As the chart below demonstrates, March and April 2020 saw a noticeable jump in the number of canceled flights – 41% of scheduled passenger flights were canceled in April -- (the red segments in the chart below) as airlines scrambled to adjust their flight schedules amid uncertainty as the pandemic grew and lockdowns spread. The plunge in the thin gray line shows the low point in scheduled flights in May resulting in that month’s record-low of 180,151 operated flights, from the 680,165 operated flights in May 2019. The number of passenger flights grew back somewhat through the summer, retracted slightly in September, and again began to climb through the end of the year. At year’s end in December, passenger airlines operated 58% of the number of flights operated in December 2019.

NOTE: A flight is listed as canceled if it was listed in a carrier’s computer reservation system during the seven calendar days prior to a scheduled departure but was not operated.

All told, airlines operated 4,721,342 domestic passenger flights in the full year 2020, a 41% drop from the 7,938,055 flights in 2019.

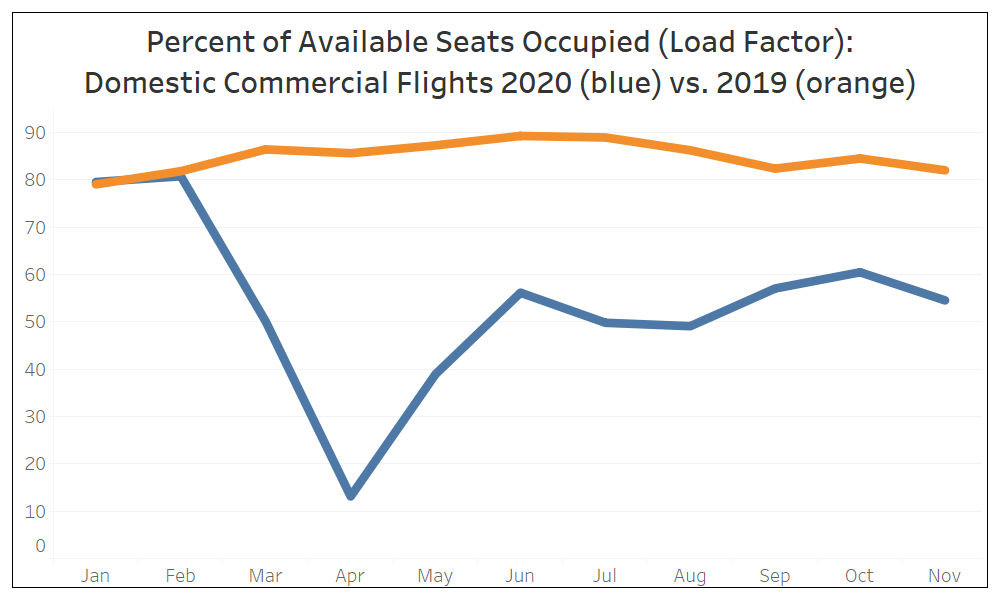

That drop in flight numbers was compounded by a drop in the number of passengers on each flight. On domestic flights through the first 11 months of 2020, only 54% of seats were occupied compared with 85% for the same months in 2019.

Airline profits, employment suffer steep declines.

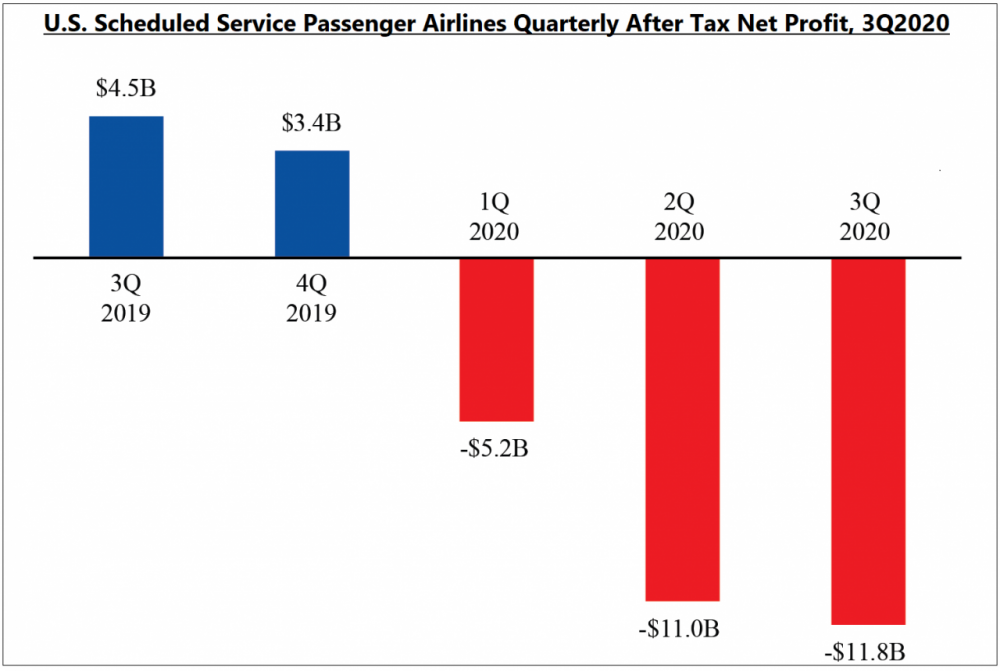

Declining numbers of flights and passengers left U.S. airlines with net losses in the first three quarters of 2020. As depicted in the chart below, the drop from the Q3 2019 after-tax net profits of $4.5B to a Q3 2020 net loss of $11.8B was greater than 350%.

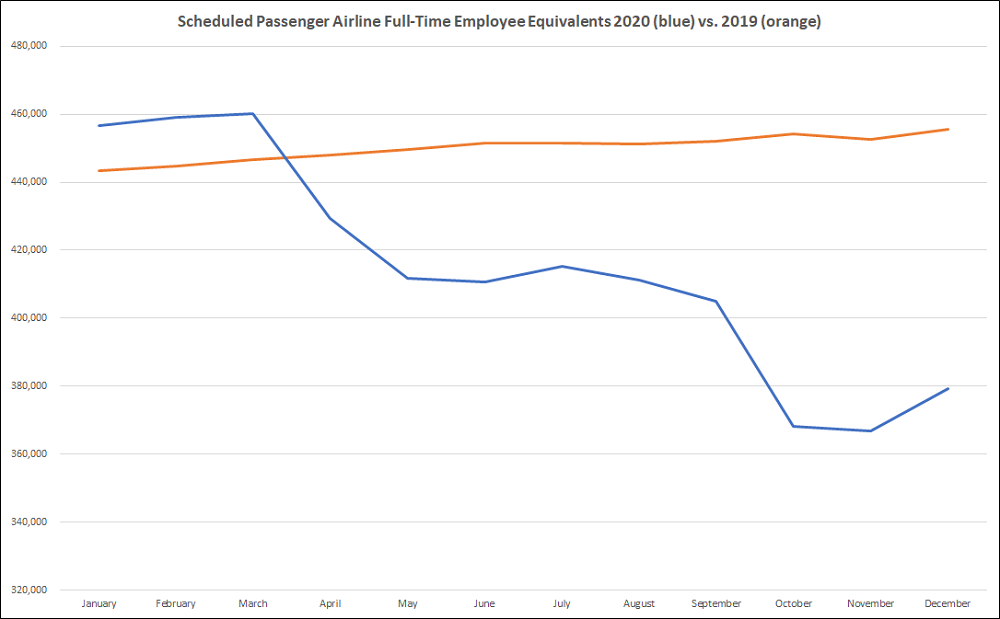

Declining numbers of flights and passengers also led to declining employment numbers, particularly among passenger airlines as depicted below. December 2020 marked the lowest December employment figure on record, surpassing even the recession year of 2009. The 379,302 full-time equivalent employees in December 2020 showed a reversal in the recent trend ending the year slightly higher than the previous two months. November, with 366,750 FTEs, was the lowest count since BTS began tracking airline employment in 1990. For airlines and their employees, the year-end hiring increase is a promising sign.

NOTE: Airlines receiving funds under the CARES Act were prohibited from layoffs or furloughs until Sept. 30.

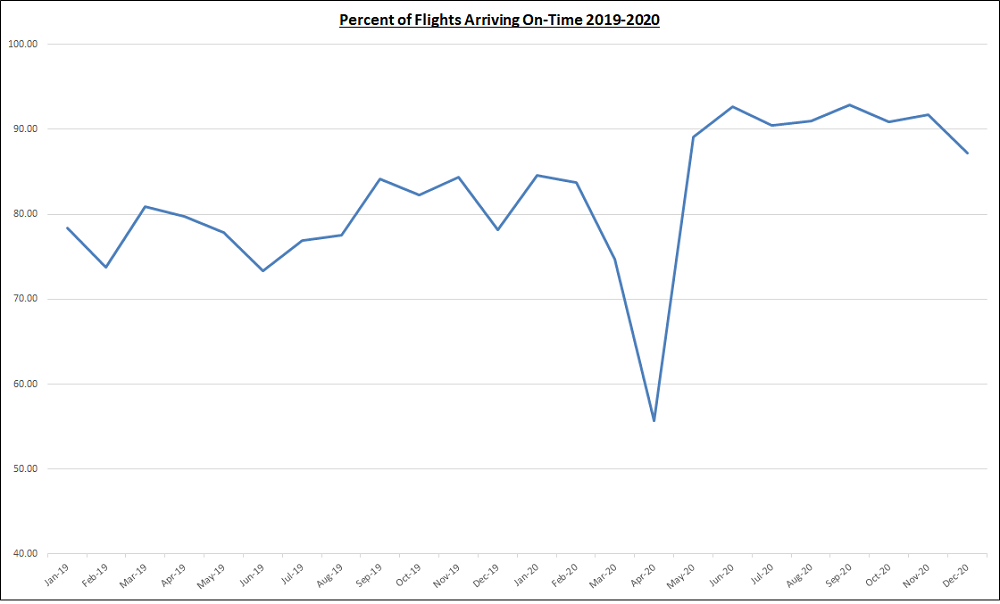

On-time arrival rates for passengers went up as airlines operated fewer flights.

One outcome of reduced flight schedules has been an increase in on-time arrival rates. When airline schedules found their footing, after the initial two months (March-April 2020) that followed the pandemic outbreak, passengers experienced a string of eight consecutive months (May-Dec. 2020) with the highest on-time arrival rates in the past 25 years. From June through November, on-time arrival percentages exceeded 90%. The full-year on-time arrival rate of 84.5% was the highest in 25 years of comparable numbers. The reduced flight schedule also resulted in the lowest number of flights delayed on the tarmac for more than an hour since BTS began keeping records in 1995.

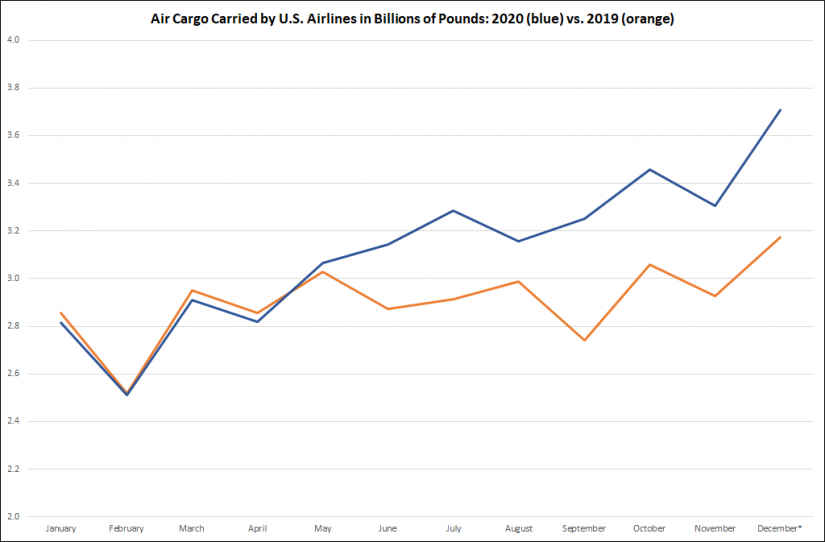

Air cargo increase offers an industry bright spot.

The decline in passenger revenue was deeply felt by airlines and their employees. However, 2020 was a record year in the amount of cargo carried by airlines. From May 2020 through the end of the year, U.S. airlines carried 1.34M more tons of cargo than in the same period in 2019 for a jump of 11%. That includes 13% more domestic cargo and 6% more international cargo.

NOTE: Cargo includes freight and mail carried within the U.S. and between the U.S. and foreign points.

For the full year 2020, U.S. airlines carried 1.28M more tons of cargo than in 2019 for a 7% increase. That included an increase of 10% in domestic cargo and less than 1% in international cargo.