Transportation Public Finance Statistics (TPFS)

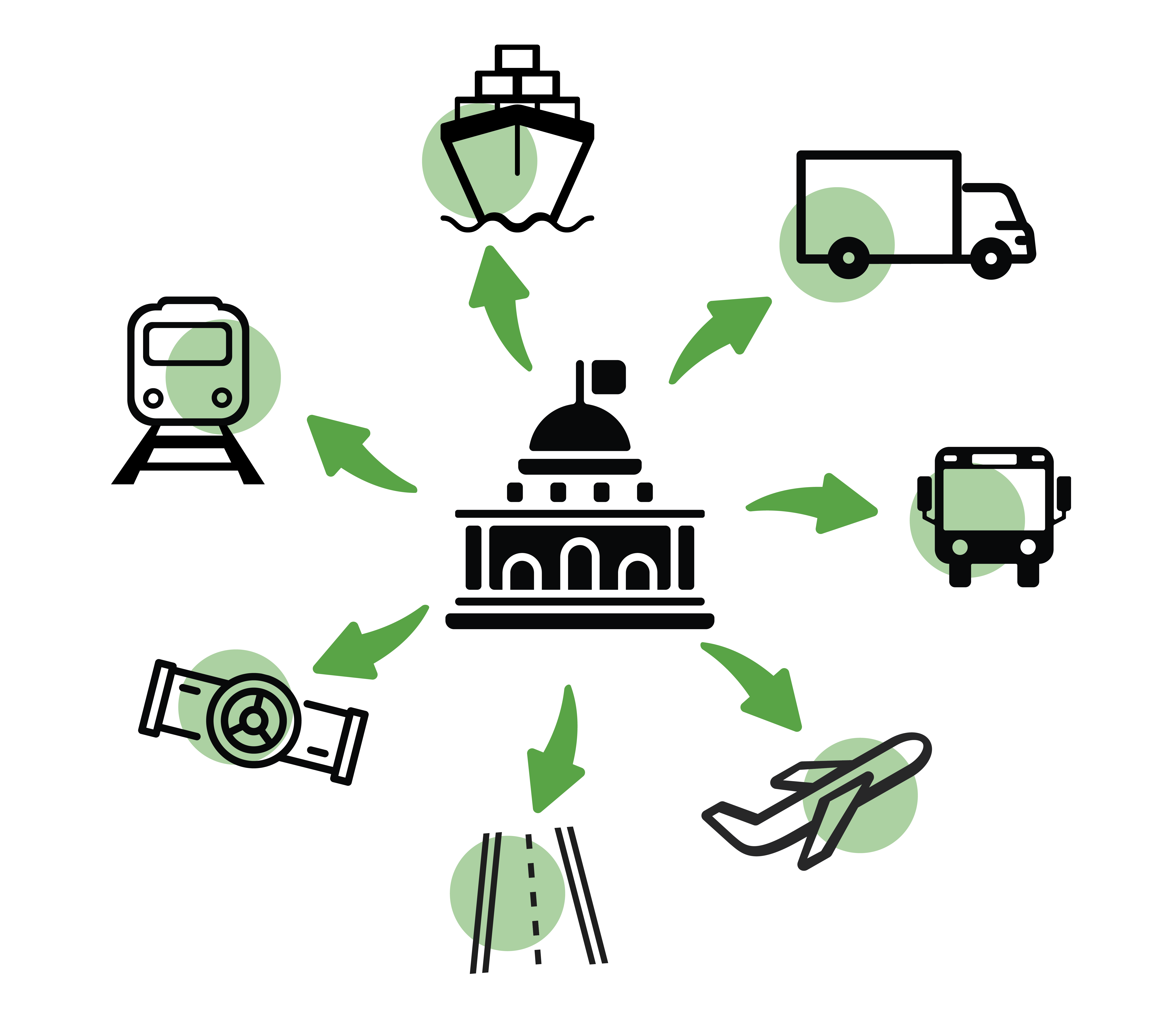

Transportation Public Finance Statistics (TPFS) provides information on transportation-related revenue and expenditures for all levels of government, including federal, state, and local, and for all modes of transportation.

State-Level values for 2020-2023 are now available! The Bureau of Transportation Statistics (BTS) has released a new set of transportation-related revenue and expenditure data at the state and local level for the highways, transit, and air transportation modes. This release includes complete data for those three modes for 2020-2022 and 2023 data for the transit and air modes.

TPFS Release Schedule:

- June: preliminary release for the Aggregate State TPFS and partial State-Level TPFS (air and transit)

- December: final release for the Aggregate State TPFS and complete State-Level TPFS (air, transit, and highway)

Download Full Aggregate State Dataset

Aggregate State Data Tabulation Tool

Download Full State-Level Dataset

State-Level Data Tabulation Tool

TPFS Data Visualizations in Transportation Economic Trends

TPFS also expands on the categories of revenues and expenditures:

- Revenue separated by:

- Own-Source: includes user-based revenue and other revenue received directly or directly generated by transportation agencies (e.g., dedicated taxes levied by transportation agencies, other operating revenue received directly by transportation agencies). Own-source revenue can also have a sub classification of user-based.

- User-Based: includes only revenue generated from charges on users of the mode related to their transportation activity (e.g., fuel taxes, motor vehicle taxes and fees, and tolls for highways, transit fares, etc.).

- Other: revenue that is not user-based

- Supporting: funds collected from non-transportation-related activities but dedicated to support transportation programs, e.g., receipts received by state and local governments from sales or property taxes. It excludes funds raised from transportation-related activities but used to finance programs other than transportation.

- Own-Source: includes user-based revenue and other revenue received directly or directly generated by transportation agencies (e.g., dedicated taxes levied by transportation agencies, other operating revenue received directly by transportation agencies). Own-source revenue can also have a sub classification of user-based.

- Expenditures separated by:

- Capital: outlays for new equipment and structures and for improving or enhancing the capacity and quality of the existing equipment and structures. TPFS defines capital expenditures by the useful life; TPFS classifies expenditures as capital improvements that last more than one year.

- Non-Capital: includes operation and maintenance costs, as well as research, administration, and other costs government agencies incur in managing transportation systems that are not classified as capital investments.

-

BTS releases preliminary estimates in June in addition to the final annual release in December. By releasing preliminary estimates in June, BTS increased the timeliness of the statistics by 6 months, reporting preliminary estimates 18 months after the one-year reference period (e.g., data for the 2023 reference period is published in June 2025). The final annual release of TPFS occurs 24 months after the one-year reference period (e.g., data for the 2023 reference period is published December 2025). The TPFS Technical Documentation details the estimation methodology.

The Federal Highway Administration did not release the local highway revenue and expenditure data for 2023, thus BTS omitted highway in the 2023 state-level data. Aggregate state data does include highways for 2023, and BTS continues to use the preliminary estimates for the local line items with missing data.

The TPFS User Guide details the classifications and sources for data.

A core part of the BTS mission is to provide the transportation financial statistics needed to inform the policy and management decision-making of a variety of transportation actors, including policymakers at all levels of government.

The government plays an important role in the U.S. transportation system, as a provider of transportation infrastructure and as an administrator and regulator of the system. The government spends a large amount of funds on building, rehabilitating, maintaining, operating, and administering the transportation system. Government revenue generated from several sources including user fees, taxes from transportation and non-transportation-related activities, and grants from federal, state, and local governments primarily supports these activities.

The Infrastructure Investment and Jobs Act (IIJA) provided approximately $673.8 billion for transportation over 5 years. IIJA's impact on transportation expenditures will be captured in 2022-2026 releases. For more details on those funds, visit Statistics on Transportation Funding in IIJA.

The Coronavirus Aid, Relief and Economic Security (CARES) Act, the Consolidated Appropriations Act 2021 (CRRSA Act), and the American Rescue Plan (ARP) Act – impacted transportation expenditures. The CARES Act funded $114.8 billion in transportation expenditures in 2020 and the CRRSA Act funded $45.0 billion in transportation expenditures and the ARP funded $58.4 billion for in transportation expenditures in 2021. For more information on those funds, visit COVID-19 Stimulus Funding for Transportation.