North American Freight Data Reveals Growth in Unsung Trade Modes

Data spotlights represent data and statistics from a specific period of time, and do not reflect ongoing data collection. As individual spotlights are static stories, they are not subject to the Bureau of Transportation Statistics (BTS) web standards and may not be updated after their publication date. Please contact BTS to request updated information.

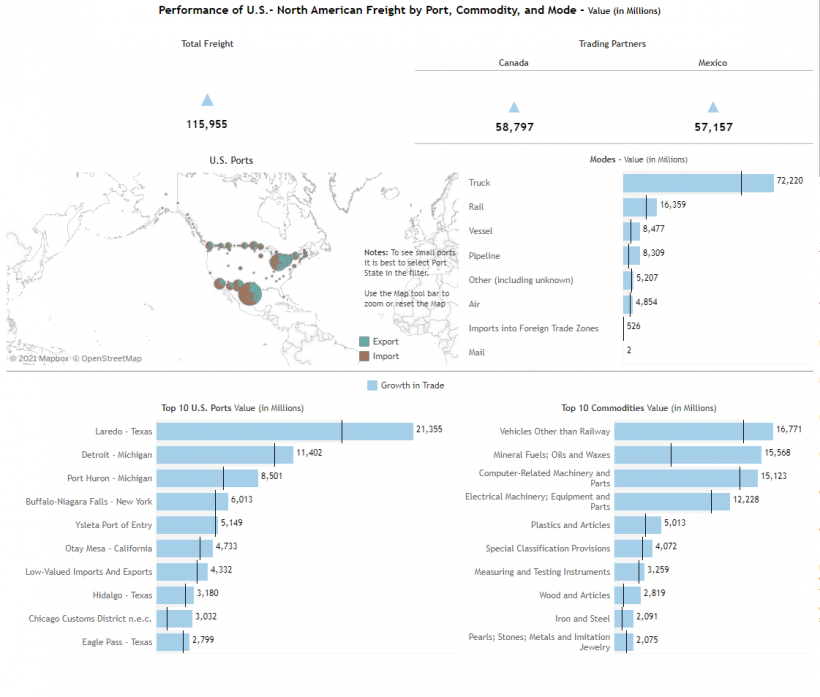

There has been a lot of attention lately on challenges to the supply chain since the onset of COVID-19, most of it focused on goods flowing into and out of West Coast ports. One aspect of U.S. trade attracting less attention is North American freight flows, which have increased since the pandemic lows we saw in the spring of 2020. Trucking and rail carry most of our trade (76%) with Canada and Mexico, but the most significant percentage increases we observed in June 2021 came from two other sources: air and pipelines.

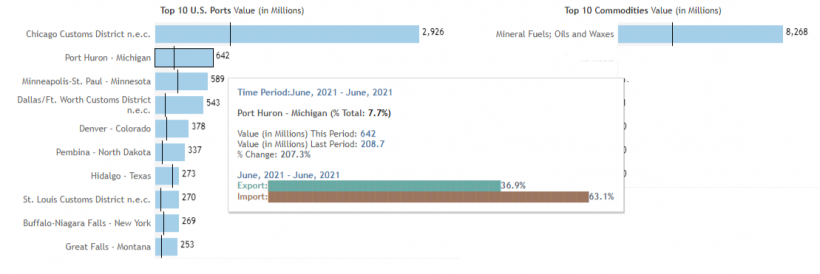

With the BTS Transborder Dashboard, we can dig into the data to find out what’s driving these increases.

Freight flowing through pipelines more than doubled year-over-year.

Pipelines carried about $8.3 billion in trade in June or about 7.2% of total North American U.S. trade. That’s an increase of 41% from pre-pandemic June 2019 and 203% from June 2020 when trade was in the early phase of recovery from the decline initiated by the COVID-19 outbreak. More than 99% of that trade is in mineral fuels, like oil, 82% of which is inbound (imports). More than 91% of pipeline trade ($7.6 billion) is with Canada, and the other $730 million is with Mexico.

Airborne freight includes a wide range of products.

In June, airplanes flew $4.8 billion in North American freight. That's only about 4.2% of U.S. trade with Canada and Mexico, but represents an increase of 26% from pre-pandemic 2019 and 44% from June 2020. Air cargo is more diverse than pipeline trade. $1.1 billion of June 2021 air cargo (up 55% from 2020) was pearls, stones, metal, and imitation jewelry, $529 million of which flew into or out of the country through Cleveland. Another $1 billion (up 33% from 2020) was electrical equipment and machinery, $445 million of which flew through New Orleans. Computer-related equipment ($586 million, up only 3%) and pharmaceuticals ($530 million, up nearly 500% from 2020) were the next most-valued airborne products.

Top Products Shipped by Air between U.S. and Canada and U.S. and Mexico, June 2021

| Product | $ Value in Millions | % Chg Year-Over-Year | Top U.S. Port of Entry/Exit | % Exported to Canada | % Exported to Mexico | % Imported from Canada | % Imported from Mexico |

| Pearls, Stones, Metals, Imitation Jewelry | 1102 | 56% | Cleveland | 52% | 5% | 29% | 14% |

| Electrical Machinery, Equipment, Parts | 1001 | 33% | New Orleans | 30% | 31% | 13% | 26% |

| Computer-Related Machinery, Parts | 586 | 3% | New Orleans | 36% | 26% | 24% | 13% |

| Pharmaceutical Products | 530 | 490% | Cleveland | 58% | 38% | 5% | 0% |

| Aircraft, Spacecraft, Parts | 466 | 50% | New Orleans | 52% | 32% | 16% | 1% |

| Measuring and Testing Instruments | 465 | 34% | New Orleans | 50% | 12% | 27% | 11% |

| Special Classification Provisions | 294 | 14% | New Orleans | 0% | 0% | 68% | 32% |

| Miscellaneous Chemical Products | 71 | -9% | New Orleans | 71% | 15% | 14% | 1% |

| Inorganic Chemicals | 47 | 87% | New Orleans | 8% | 28% | 64% | 0% |

| Vehicles (other than Railway) | 31 | 98% | New Orleans | 21% | 53% | 5% | 21% |

TransBorder Dashboard is a powerful gateway to data on freight flows with America’s largest trading partners.

This examination of air cargo and pipeline trade is just one line of inquiry you can pursue using the BTS TransBorder Dashboards. What three commodities increased the most over the last year? Which U.S. land port is the busiest--by far? What mode of freight transport is up 125% from last year but only 7% from 2019? Answers to these and other questions can be found at https://www.bts.gov/transborder.