Twenty Years Later, How Does Post-9/11 Air Travel Compare to the Disruptions of COVID-19?

Data spotlights represent data and statistics from a specific period of time, and do not reflect ongoing data collection. As individual spotlights are static stories, they are not subject to the Bureau of Transportation Statistics (BTS) web standards and may not be updated after their publication date. Please contact BTS to request updated information.

In December 2005, the Bureau of Transportation Statistics published a report on “Airline Travel Since 9/11.” It came four years after the devastating attack caused a tragic loss of life and a significant contraction in U.S. air travel. The 20-year anniversary of 9/11 coincides with another devastating event, the COVID-19 pandemic, that is also affecting air travel. How do the effects of these two events on air travel compare?

Comparing Air Travel between 9/11 and COVID-19

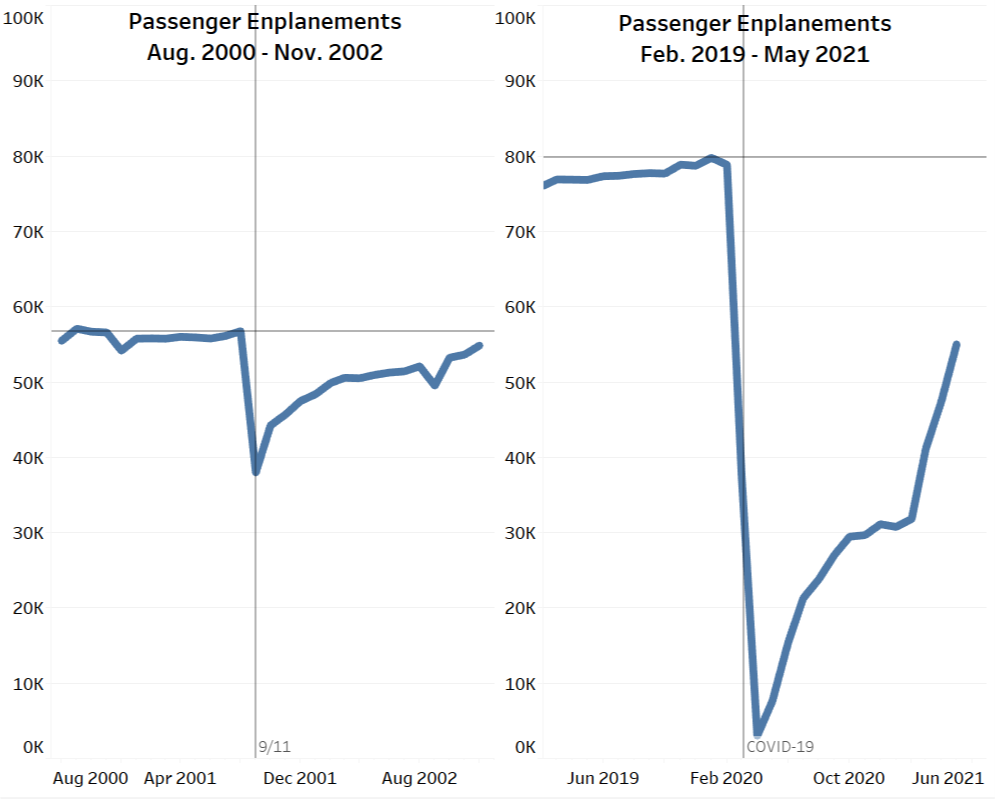

NOTE: Passenger enplanements above are for domestic and international flights by U.S. carriers.

SOURCE: BTS Seasonally Adjusted Data, https://data.bts.gov/stories/s/j32x-7fku.

As the charts above show, the immediate impact of both events was a severe drop in the number of passengers traveling by air with one key difference. The drop in monthly passengers in September 2001 from the previous month is significantly less steep (33%) than the drop in 2020 (96%). Both charts are for the same number of months before and after the onset of the disruption.

Recovery times necessarily vary.

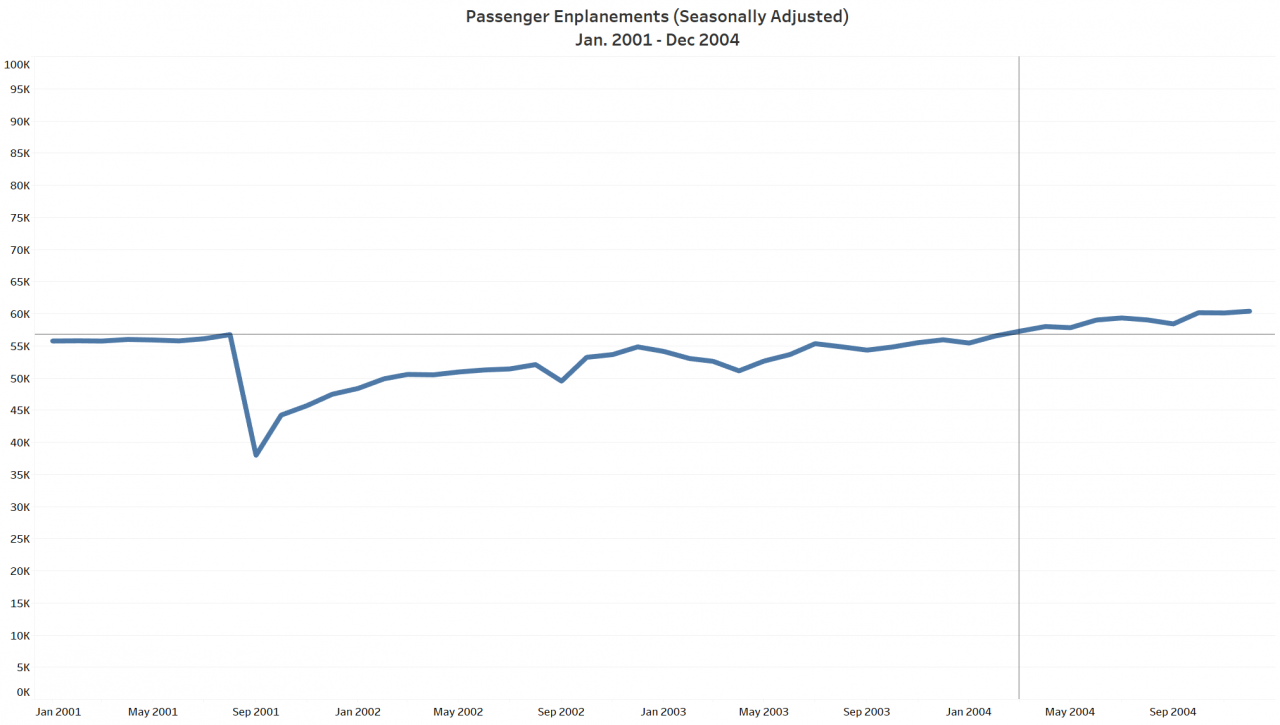

All air service in the United States was suspended on 9/11, but the aviation system was restored within days. Passenger travel by commercial airlines did not recover until March 2004 when the number of passengers enplaned returned to the August 2001 level.

Air Travel Recovery from 9/11

NOTE: Passenger enplanements above are for domestic and international flights by U.S. carriers.

SOURCE: BTS Seasonally Adjusted Data, https://data.bts.gov/stories/s/j32x-7fku.

In contrast, the COVID-19 pandemic disrupted aviation service over many months through a patchwork of travel restrictions among states and foreign destinations. By June 2021 (15 months after the initial lock-downs in March 2020), air travel had recovered to the point that the largest U.S. airlines carried 82% of the passengers (66.4M) carried in June 2019 (81.4M).

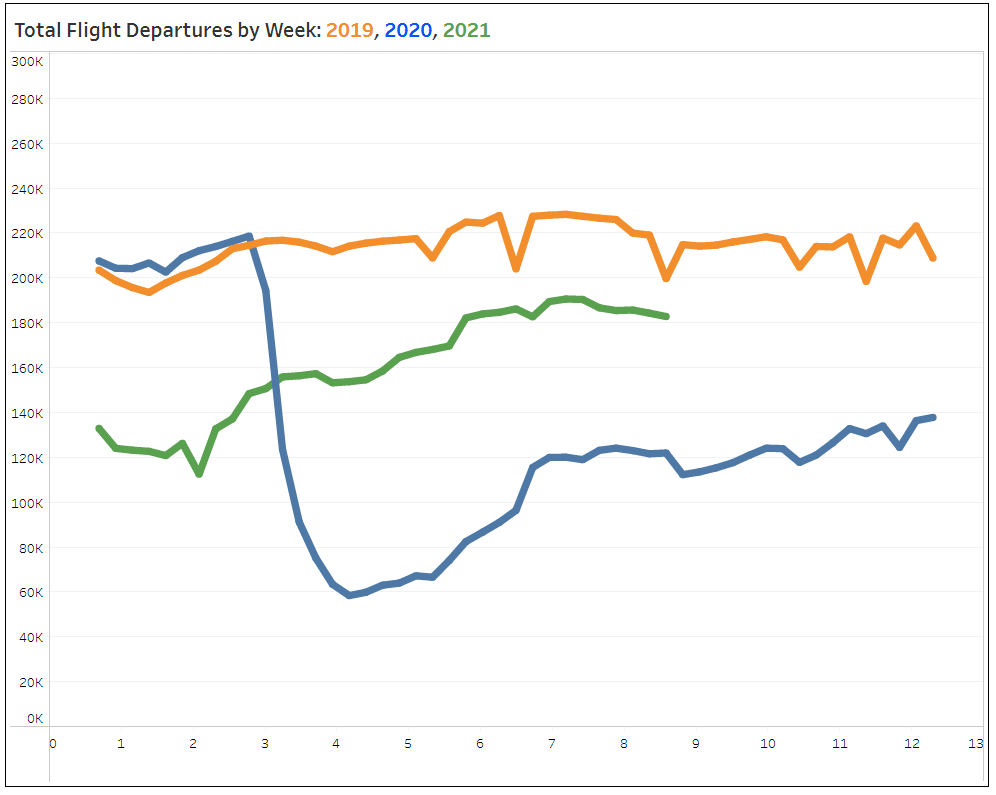

A Slow Return Toward Pre-COVID-19 Air Travel Activity

NOTE: Flight departures above are for domestic and international flights by U.S. carriers.

SOURCE: BTS, https://www.bts.gov/twit

As the chart above shows, the number of departing flights each week since May 2020 (2020 in blue and 2021 in green) has been inching toward the number of flights in the corresponding week in 2019 (orange).

When passengers return, will airlines add capacity, or will flights have fewer empty seats?

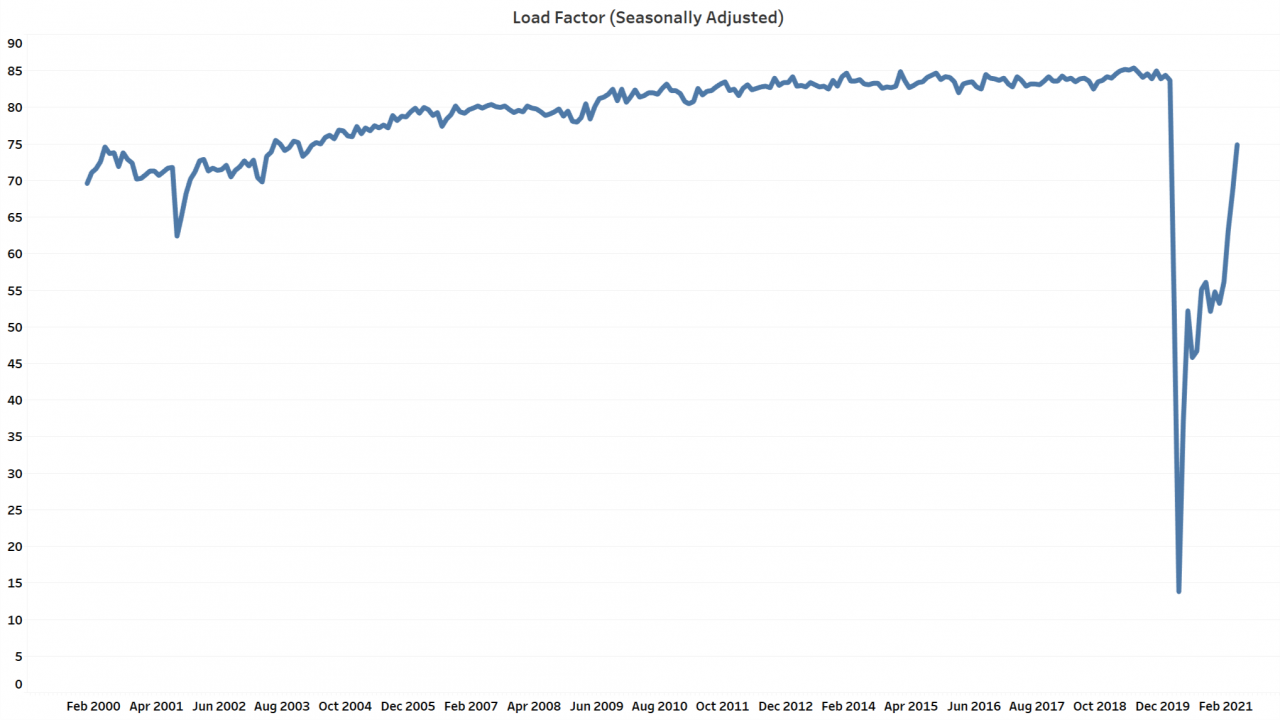

In the 2005 report, BTS noted that the number of passengers had increased since 9/11 at a faster rate than the number of available seats. Flights had fewer empty seats as what the industry calls “Load Factor” increased. The chart below shows that the change observed in 2005 did not abate until the onset of COVID-19.

Fewer Empty Seats After 9/11 Until COVID-19

NOTE: Passenger enplanements above are for domestic and international flights by U.S. carriers.

SOURCE: BTS Seasonally Adjusted Data, https://data.bts.gov/stories/s/j32x-7fku.

In the months before 9/11, passenger aircraft were flying at around 73% of capacity. By February 2020, load factor for U.S. carrier domestic and international flights had increased to about 85%.

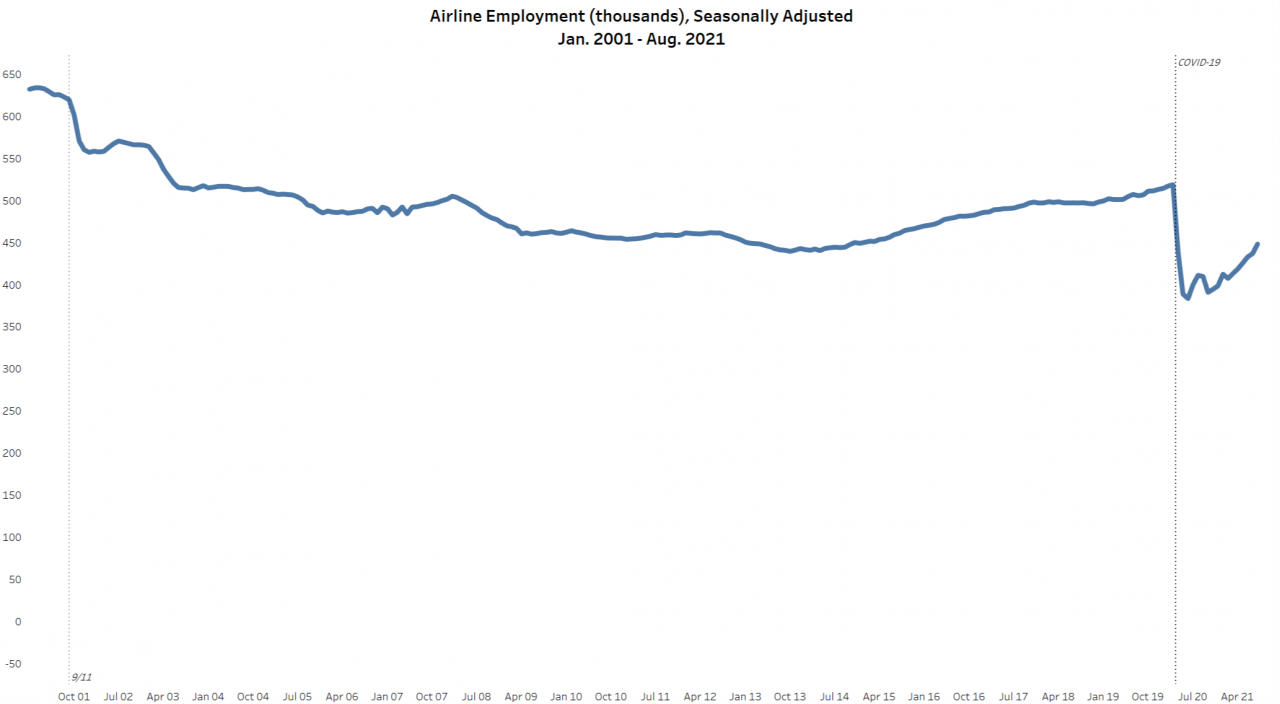

Airline employment has changed between crises.

In 2005, when BTS published the post-9/11 report, airlines were still operating with 28% fewer employees than in July 2001. This was despite the fact that the number of flights and passengers had returned to pre-9/11 levels, indicating what we described in the 2005 report as the industry cutting costs. Airline employment continued to remain below pre-9/11 levels even as the number of flights and passengers hit all-time highs in the months before the pandemic.

When Air Passengers Returned, Post-9/11, Airline Jobs Didn't

SOURCE: BTS analysis of Bureau of Labor Statistics Data, https://data.bts.gov/stories/s/28xr-p3t9.

In August 2021, just 16 months after the April 2020 COVID-19 low point in flights and passengers, air transportation employment was already at 86% of pre-pandemic levels although the number of flights and passengers has still not caught up to pre-pandemic levels.

What does air travel look like in September 2021?

While we hear anecdotes of crowded flights and a U.S. shortage of labor, the data does not yet make it clear how much and for how long air travel has been affected by either. In May 2021, average load factor –although higher than at its pandemic low point— remained significantly lower than the pre-pandemic norm. And, June 2021 passenger airline employment is significantly closer to the pre-pandemic level than July 2005 employment was to its pre-9/11 level. How COVID variants affect the availability of aviation employees, how months of telework affect business travel by air, and how other aspects of air travel are affected by the pandemic remain to be seen.