Third Quarter 2020 Air Fare Drops to New Low as Passenger Numbers Decline

Release Number: BTS 07-21

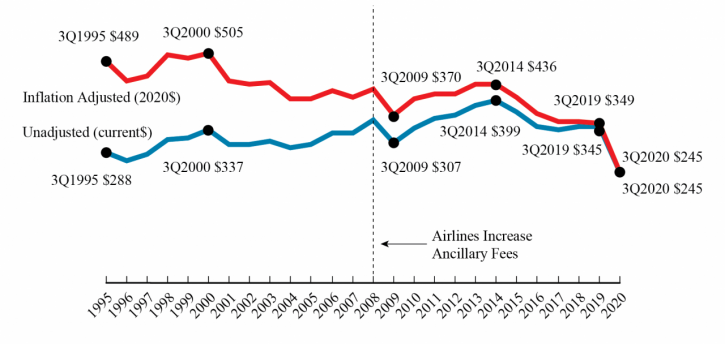

The average U.S. domestic air fare declined in the third quarter of 2020 to $245, the lowest inflation-adjusted average quarterly air fare in Bureau of Transportation Statistics (BTS) records dating back to 1995. The previous low was $262 in the second quarter of 2020.

Adjusted for inflation (constant 2020 dollars) the average 3Q 2020 air fare was:

- Down 29.9% from 3Q 2019 ($349)

- Down 6.7% from 2Q 2020 ($262)

- Down 40.0% from 3Q 2015 ($408)

Air fares declined along with passenger demand. U.S. airlines reported 27 million originating passengers in the third quarter of 2020, down from 86 million passengers a year earlier.

The percent change is based on unrounded numbers. COVID-19 effects on travel were significant in the July-September reporting period.

Itinerary Fares: Round-trips, but includes one-way tickets if no return is purchased.

Breakout of trip types: one-way, 45% ($202); round-trip, 55% ($285).

Fare calculations by BTS

*Based on a random sample of approximately 10% of tickets sold.

Total ticket value: The price charged by airlines at time of ticket purchase.

Included: Additional taxes and fees levied by an outside entity at time of ticket purchase.

Not included: Fees for optional services, such as baggage fees.

Other Revenue: In recent years, airlines have increasingly obtained additional revenue from passenger fees, as well as from other sources. U.S. passenger airlines collected 65.1% of total operating revenue of $38.6 billion from passenger fares during the first nine months of 2020, down from 88.5% in 1990.

Fares by Airport

Highest: 18 airports with 38,000-49,999 originating passengers ($259)

Lowest: Nine airports with 500,000-999,999 originating passengers ($228)

Additional data: see Top 100 Airports or All Airports. Fourth Quarter 2020 average fare data will be released April 20.

Standard error: Results for average fares are based on the BTS Origin & Destination Survey, a 10% sample of airline tickets used during the quarter. Averages for airports with smaller samples may be less reliable.

Note: Results for average fares are based on the BTS Origin & Destination Survey, a 10% sample of airline tickets used during the quarter. For Q3 2020 results based on all itinerary fares, the standard error is 0.30 and the median fare is $197.44.

The 90% confidence interval ranges from $244.29 to $245.28. For results based on round-trip fares, the standard error is 0.52 and the median fare is $236.70. The 90% confidence interval ranges from $283.03 to $284.73. For results based on one-way fares, the standard error is 0.34 and the median fare is $157.06. The 90% confidence interval ranges from $200.85 to $201.96.