First Quarter 2025 Average Air Fare Decreases 1.2% from Fourth Quarter 2024

BTS 44-25

This release is published on a fixed schedule as required by the Office of Management and Budget, and statistics in this release may be revised when inputs to the statistics are corrected or updated. Data on the program page of this website are the most up-to-date and complete. All costs are in current dollars. All fuel consumption data is in regard to fuel paid for by the carrier.

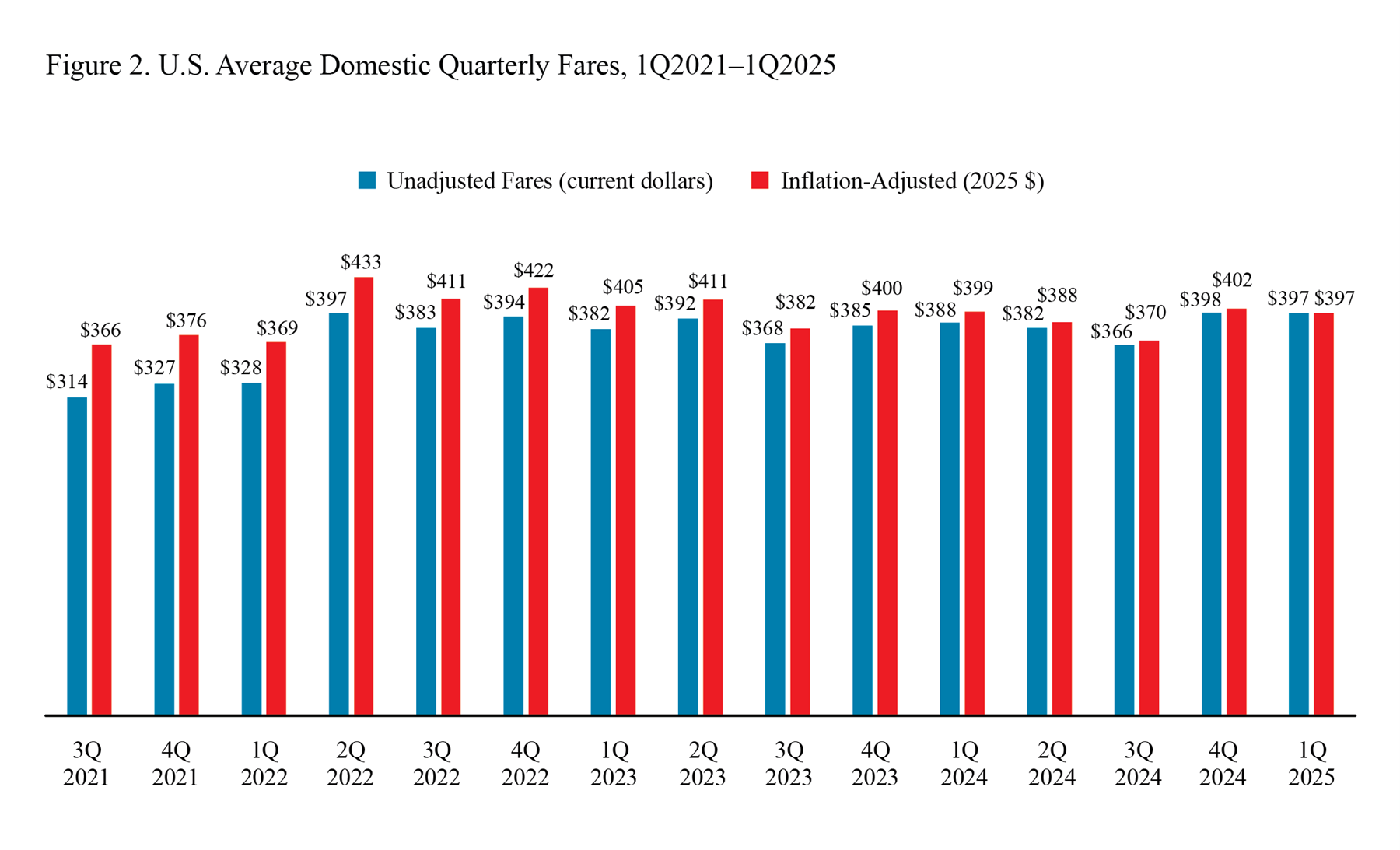

The average U.S. domestic air fare decreased in the first quarter of 2025 to $397, down 1.2% from the fourth quarter 2024 inflation-adjusted fare of $402.

Itinerary Fares: Round-trips, but includes one-way tickets if no return is purchased.

Breakout of trip types: one-way, 39% ($288); round-trip, 61% ($478).

Fare calculations by BTS

*Based on a sample of approximately 10% of tickets sold.

Total ticket value: The price charged by airlines at time of ticket purchase.

Included: All fees and charges levied by an air carrier required for the passenger to board the aircraft. Also, additional taxes and fees levied by an outside entity at time of ticket purchase.

Not included: Fees for optional services, such as baggage fees, seat upgrades, and selecting an assigned seat on the aircraft.

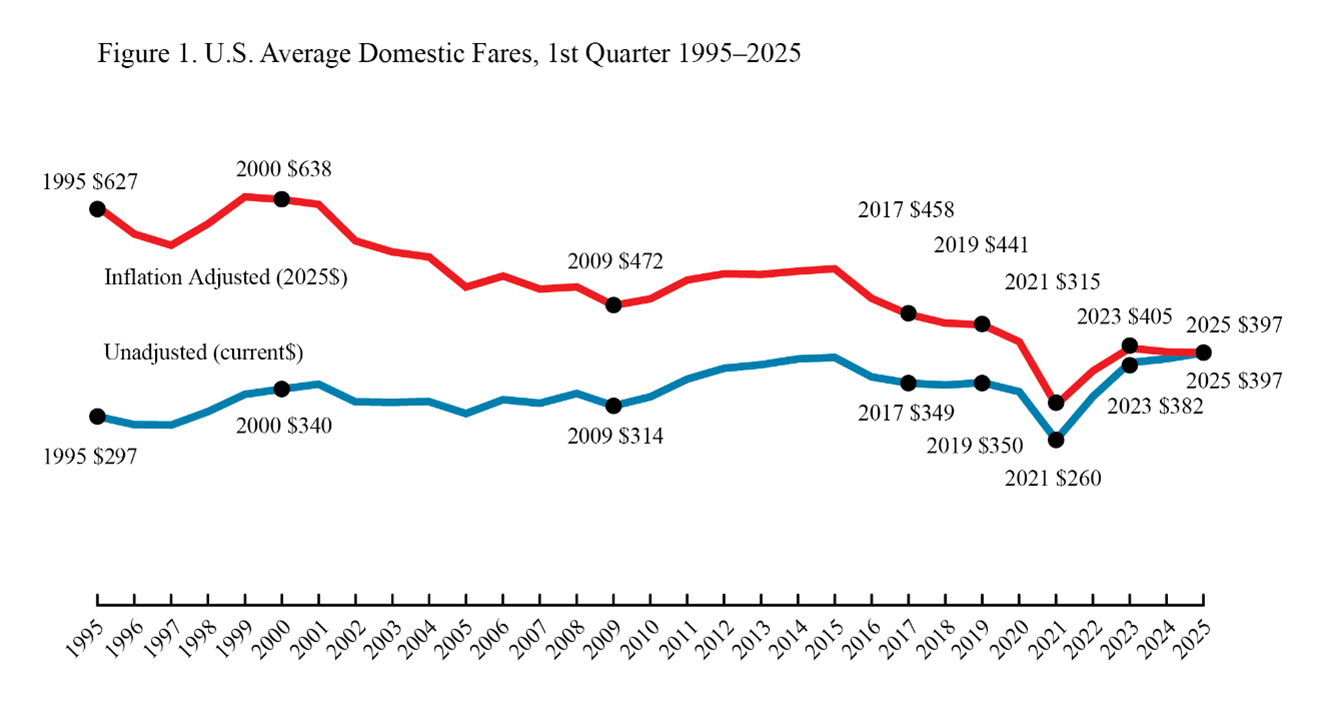

Inflation-Adjusted Average Air Fares

First Quarter 2025 fare ($397):

Compared to all first quarters: Down 38.2% from the highest 1Q fare, $643 in 1999.

Compared to all quarters: Down 38.2% from the highest fare for any quarter, $643 in 1Q 1999.

Start of BTS records: Down 36.7% from 1Q 1995 ($627).

Recent high: Down 8.2% from 2Q 2022 ($433).

Recent low: Up 32.2% from 3Q 2020 ($300).

All-time low: Up 32.2% from the previous low 3Q 2020 ($300).

All-time first quarter low: Up 26.0% from the previous low 1Q 2021 ($315).

Other Revenue: In recent years, airlines have increasingly obtained additional revenue from passenger fees, as well as from other sources. U.S. passenger airlines collected 73.7% of total operating revenue of $42.4 billion from passenger fares during the three months of 2025, down from 88.5% in 1990.

Unadjusted Average Air Fares

First Quarter 2025 fare ($397):

Trend: Down 0.13% from 4Q 2024 ($398).

Compared to all first quarters: Up 1.8% from the highest 1Q fare, $390 in 2015.

Compared to all quarters: Down 1.3% from the highest fare for any quarter, $402 in 2Q 2014.

Start of BTS records: Up 33.8% from 1Q 1995 ($297) (compared to 111.3% consumer price increase).

Recent low: Up 62.3% from 3Q 2020 ($245).

Recent high: Down 0.13% from 4Q 2024 ($398).

All-time low: Up 62.3% from 3Q 2020 ($245).

All-time first-quarter low: Up 52.6% from 1Q 2021 ($260).

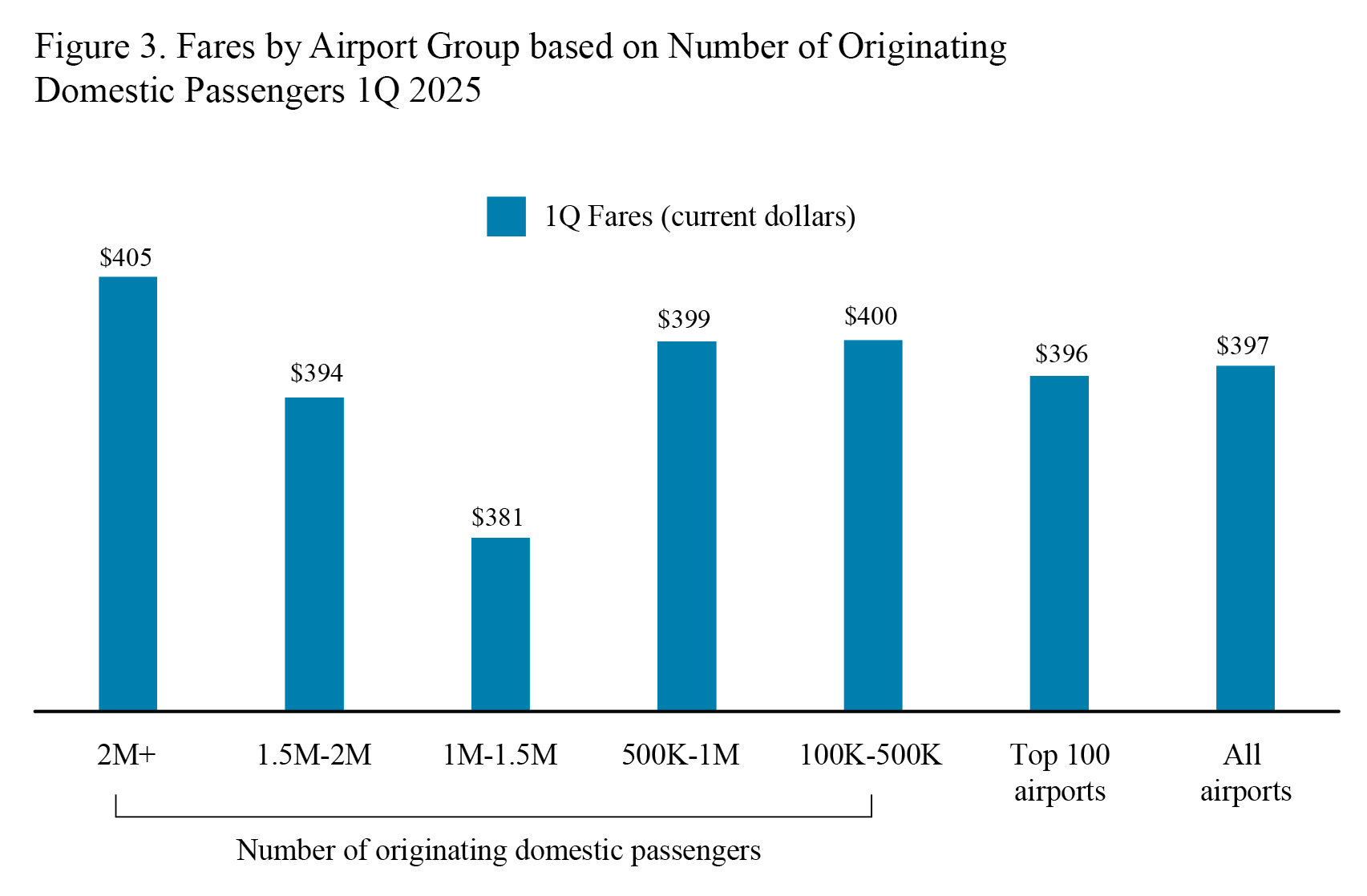

Fares by airport group:

Highest: 6 airports with 2.0 million plus originating passengers ($405)

Lowest: 10 airports with 1.0-1.49 million originating passengers ($381)

Additional data: see Top 100 Airports or All Airports. Second Quarter 2025 average fare data will be released on or before October 21, 2025.

To receive updates from BTS directly to your email, please consider subscribing to our GovDelivery service.