November 2019 North American Transborder Freight Numbers

Transborder freight between the U.S. and other North American countries (Canada and Mexico) in November 2019:

- Total Transborder Freight: $99.0 billion of transborder freight moved by all modes of transportation, down 3.9% compared to November 2018

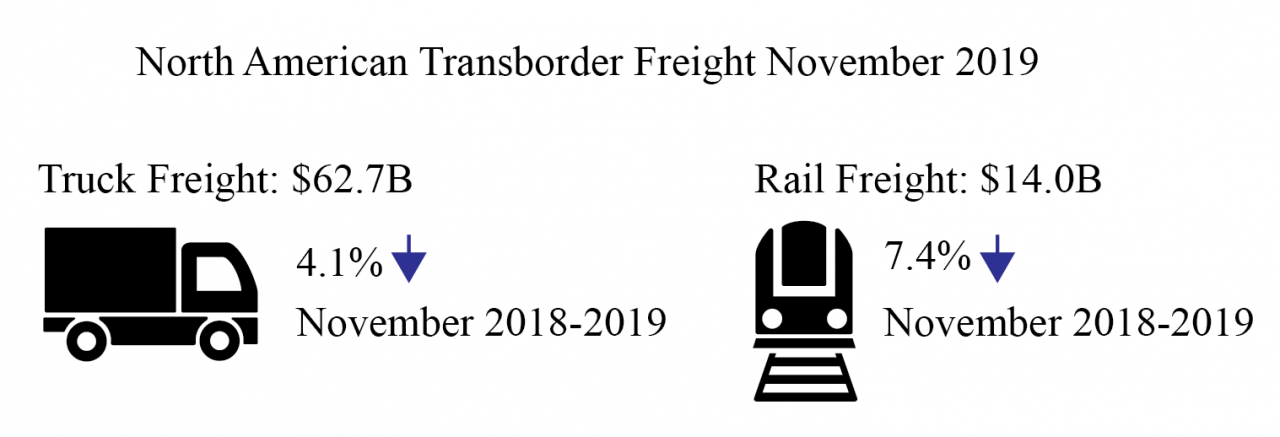

- Most-used mode: Trucks moved $62.7 billion of freight, down 4.1% compared to November 2018

- Second most-used mode: Railways moved $14.0 billion of freight, down 7.4% compared to November 2018

Vessel shipments rose 4.5% as vessel transport of mineral fuels rose 11.8% or $576 million in a shift from rail and pipeline. Air shipments rose 3.5%.

Truck Freight: $62.7 billion (63.3% of all transborder freight)

- By border:

- Compared to November 2018:

- Three busiest truck border ports (46.1% of total transborder truck freight)

- Laredo, TX $14.6 billion

- Detroit, MI $8.9 billion

- El Paso, TX $5.4 billion

- Top three truck commodities (50.5% of total transborder truck freight)

- Computers and parts $12.2 billion

- Electrical machinery $10.2 billion

- Motor vehicles and parts $9.2 billion

Rail Freight: $14.0 billion (14.2% of all transborder freight)

- By border:

- Compared to November 2018:

- Three busiest rail border ports (56.1% of total transborder rail freight)

- Laredo, TX $3.8 billion

- Detroit, MI $2.2 billion

- Eagle Pass, TX $1.9 billion

- Top three rail commodities (65.5% of total transborder rail freight)

- Motor vehicles and parts $7.3 billion

- Mineral fuels $1.2 billion

- Computers and parts $0.7 billion

Total Transborder Freight by Mode:

Reporting Notes

Data in this Bureau of Transportation Statistics release are not seasonally adjusted and are not adjusted for inflation. For previous statistical releases and summary tables, see TransBorder Releases. See TransBorder Freight Data for data from previous months, and for additional state, port, and commodity data. BTS has scheduled the release of December TransBorder numbers for Feb. 25.