U.S. Airlines Show First Profit Since COVID-19 in 2nd Quarter 2021

BTS 55-21

BTS Contact: Todd Solomon

todd.solomon@dot.gov

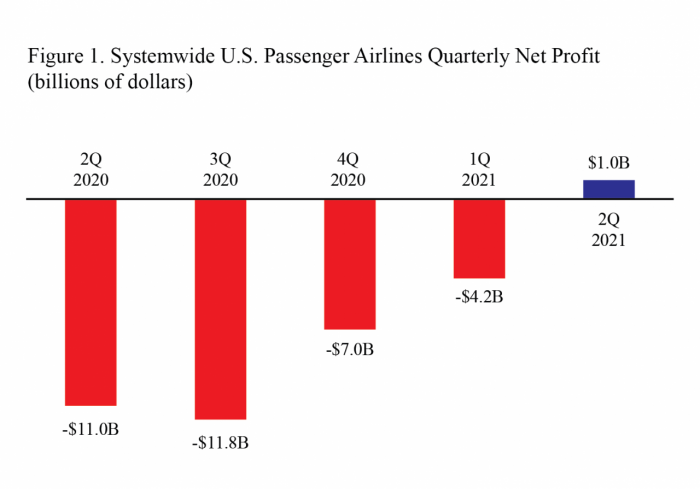

U.S. scheduled passenger airlines reported a second-quarter 2021 after-tax net profit of $1.0 billion despite a pre-tax operating loss of $3.6 billion. The second-quarter results represent the first quarterly profit since the fourth quarter of 2019, the last quarter before the COVID-19 pandemic began.

In the second quarter of 2021, the airlines reduced their first-quarter losses by 124%. The second-quarter after-tax net profit of $1.0 billion was a $5.2 billion net change from the first-quarter loss of $4.2 billion. The second-quarter pre-tax operating loss of $3.6 billion was a $9.1 billion reduction from the first-quarter loss of $12.7 billion.

U.S. airline financial reports are filed quarterly with the Bureau of Transportation Statistics (BTS). See the tables that accompany this release on the BTS website for additional second-quarter 2021 financial results (Tables 1-6).

Payroll protection payments received by airlines are included in net income calculations as part of non-operating income.

Systemwide operations, includes 24 U.S. airlines:

After-tax net profit/loss (net income)

- $1.0 billion profit in 2Q 2021

- Compared to $4.2 billion loss in 1Q 2021

- Compared to $11.0 billion loss in 2Q 2020

- Compared to $4.8 billion profit in pre-pandemic 2Q 2019

Pre-tax operating profit/loss

- $3.6 billion loss in 2Q 2021

- Compared to $12.7 loss in 1Q 2021

- Compared to $16.3 billion loss in 2Q 2020

- Compared to $6.9 billion profit in pre-pandemic 2Q 2019

Total 2Q 2021 operating revenue: $31.6 billion

Share of total 2Q 2021 operating revenue:

- Fares: $20.7 billion, 65.5%, compared to $4.0 billion in 2Q 2020

- Baggage fees: $1.4 billion, 4.4%, compared to $221.2 million in 2Q 2020

- Reservation change fees: $137.2 million, 0.4%, compared to $80.8 million in 2Q 2020

Fees are included for calculations of net income, operating revenue and operating profit or loss.

Total 2Q 2021 operating expenses: $35.1 billion:

Share of total 2Q 2021 operating expenses:

- Fuel: $5.5 billion, 15.6%, compared to $1.2 billion in 2Q 2020

- Labor: $12.5 billion, 35.7%, compared to $11.3 billion in 2Q 2020

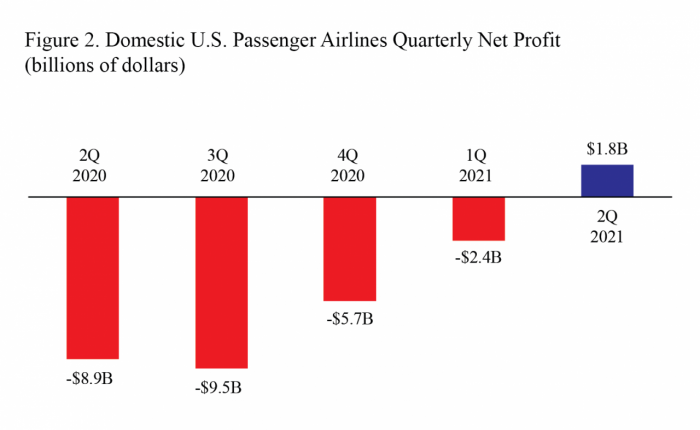

Domestic operations, includes 24 U.S. airlines:

After-tax domestic net profit/loss (net income)

- $1.8 billion profit in 2Q 2021

- Compared to $2.4 billion loss in 1Q 2021

- Compared to $9.0 billion loss in 2Q 2020

- Compared to $3.6 billion profit in pre-pandemic 2Q 2019

Pre-tax domestic operating profit/loss

- $2.1 billion loss in 2Q 2021

- Compared to $9.6 billion loss in 1Q 2021

- Compared to $14.1 billion loss in 2Q 2020

- Compared to $5.2 billion profit in pre-pandemic 2Q 2019

2Q 2021 domestic operating revenue: $26.4 billion

Share of total 2Q 2021 domestic operating revenue:

- Fares: $17.3 billion, 65.7%, compared to $3.7 billion in 2Q 2020

- Baggage fees: $1.1 billion, 4.3%, compared to $201.7 million in 2Q 2020

- Reservation change fees: $121.0 million, 0.5%, compared to $62.8 million in 2Q 2020

Fees are included for calculations of net income, operating revenue and operating profit or loss.

2Q 2021 domestic operating expenses: $28.5 billion

Share of total 2Q 2021 domestic operating expenses:

- Fuel: $4.2 billion, 14.6%, compared to $898.3 million in 2Q 2020

- Labor: $9.9 billion, 34.9%, compared to $9.5 billion in 2Q 2020

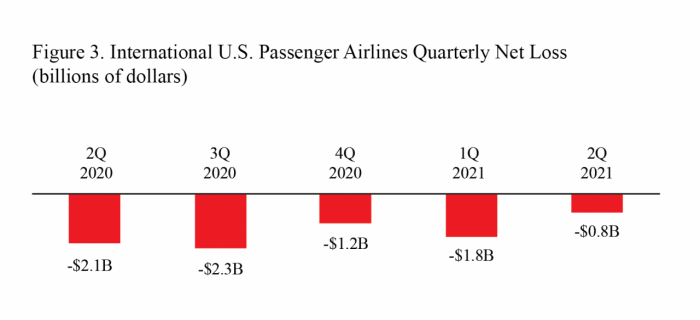

International operations, includes 19 U.S. airlines:

After-tax international net profit/loss (net income)

- $773.8 million loss in 2Q 2021

- Compared to $1.8 billion loss in 1Q 2021

- Compared to $2.1 billion loss in 2Q 2020

- Compared to $1.2 billion profit in pre-pandemic 2Q 2019

Pre-tax international operating profit/loss

- $1.5 billion loss in 2Q 2021

- Compared to $3.0 billion loss in 1Q 2021

- Compared to $2.1 billion loss in 2Q 2020

- Compared to $1.6 billion profit in pre-pandemic 2Q 2019

2Q 2021 international operating revenue: $5.1 billion

Share of total 2Q 2021 international operating revenue:

- Fares: $3.3 billion, 64.7%, compared to $340.0 million in 2Q 2020

- Baggage fees: $250.0 million, 4.9%, compared to $19.5 million in 2Q 2020

- Reservation change fees: $16.3 million, 0.3%, compared to $18.0 million in 2Q 2020

Fees are included for calculations of net income, operating revenue and operating profit or loss.

2Q 2021 international operating expenses: $6.6 billion

Share of total 2Q 2021 international operating expenses:

- Fuel: $1.3 billion, 20.0%, compared to $253.8 million in 2Q 2020

- Labor: $2.6 billion, 39.3%, compared to $1.8 billion in 2Q 2020

2nd Quarter Margins

Net margin is the net income or loss as a percentage of operating revenue. Operating margin is the operating profit or loss as a percentage of operating revenue.

Systemwide:

Net margin:

- 3.2% in 2Q2021

- Compared to -140.6% in 2Q 2020

Operating margin:

- -11.3% in 2Q2021

- Compared to -207.0% in 2Q 2020

Domestic

Net margin:

- 6.7% in 2Q2021

- Compared to -132.2% in 2Q 2020

Operating margin:

- -7.9% in 2Q2021

- Compared to -208.7% in 2Q 2020

International

Net margin:

- -15.1% in 2Q2021

- Compared to -193.0% in 2Q 2020

Operating margin:

- -28.8% in 2Q2021

- Compared to -196.0% in 2Q 2020

Reporting notes

Additional data: BTS website, see tables for operating profit/loss, operating revenue and fuel cost and consumption. See the BTS financial databases for more detailed data including numbers for individual airlines.

Filing requirement: By regulation, for the quarter ending June 30, airlines that operate at least one aircraft that is designed/certified for more than 60 seats or the capacity to carry a payload of passengers and cargo weighing more than 18,000 pounds must report financial data to BTS by August 10. The airline filings are subject to a process of quality assurance and data validations before release to the public.

Data updates: Revised carrier data and late data filings will be made available monthly on TranStats on the Monday following the second Tuesday of the month. All data are subject to revision. BTS will release third-quarter 2021 data on December 6.